Lending Against Crypto

Use Case

At DeFi Global, we are poised to revolutionize the financial landscape by introducing lending services against cryptocurrencies. Our future-focused approach aims to leverage the potential of decentralized finance (DeFi) to bring about a paradigm shift in traditional lending practices. Here are key aspects highlighting the advantages and key issues associated with lending against crypto in the context of DeFi Global:

Decentralized Accessibility: DeFi Global's lending platform will provide decentralized accessibility, allowing users worldwide to participate without the need for intermediaries. Regulatory uncertainties may emerge as a challenge, but DeFi Global is committed to working within legal frameworks to ensure complianceCollateralized Security: Lending against crypto involves collateral, enhancing the security of transactions and minimizing default risks. Proper valuation and management of diverse crypto assets will be crucial to maintaining a robust and secure lending ecosystem.

Smart Contract Automation: DeFi Global will implement smart contracts to automate lending processes, ensuring transparency and reducing the need for manual intervention. Smart contract vulnerabilities must be continuously addressed and monitored to prevent potential exploits.

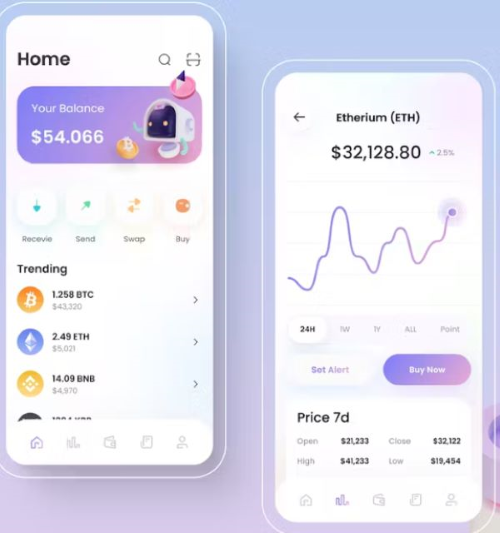

Global Market Exposure: Lenders and borrowers will have access to a global market of diverse cryptocurrencies, allowing for a wide range of investment and borrowing options. Volatility in the cryptocurrency market may pose challenges, but DeFi Global will employ risk management strategies to mitigate potential downsides.

Competitive Interest Rates: DeFi Global aims to offer competitive interest rates, fostering a fair and efficient lending marketplace. Economic conditions and market fluctuations may impact interest rates, requiring adaptive strategies for sustainable lending practices.

Community Governance: DeFi Global will implement decentralized governance models, enabling community participation in decision-making processes. Ensuring effective governance and consensus mechanisms to address evolving challenges and maintain the integrity of the platform.

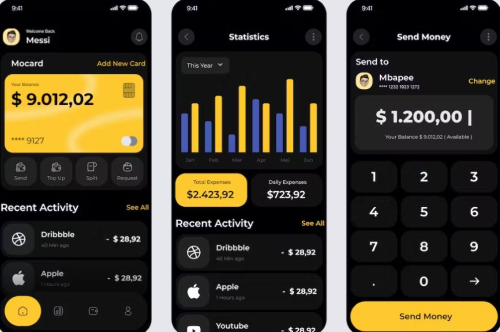

Financial Inclusion: DeFi Global's lending against crypto promotes financial inclusion by providing access to financial services for individuals who are unbanked or underbanked. Education and user-friendly interfaces will be crucial to ensure that a broader audience can easily navigate and benefit from DeFi lending.

As DeFi Global ventures into the future of lending against crypto, our commitment to innovation, security, and inclusivity will drive the development of a resilient and user-friendly decentralized financial ecosystem.

Unlocking crypto's might, at DeFi Global, lending's future is bright! contact us for free consultation and our able team will get back to you and assist you.

Start Donation CampaignDeFi Global Innovation Team English

English French

French German

German